Time installing the indicator: Just a few minutes with our MetaTrader Pro setup

What does it do?

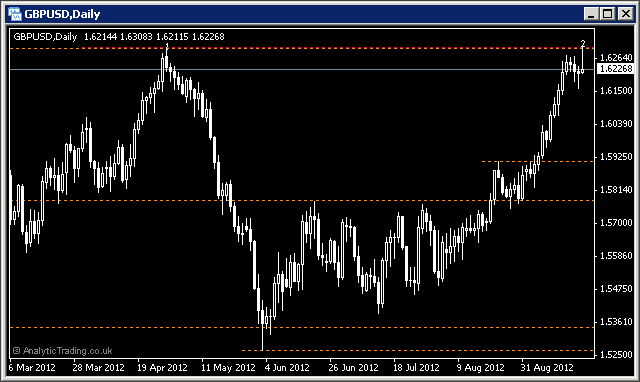

The Analytic Trading Support & Resistance Levels indicator is designed to automatically draw horizontal lines from the last few high & low price levels the higher timeframes achieved.

Due to the fractal nature of price movements, it works in the same way when used on any timeframes, and therefore, should suit all trading styles.

We think you will find it quite fascinating how often and closely price responds to these historically drawn levels, often exactly or within a few pips…

These levels are colour coded using rainbow colours to make it easier to remember what they signify – for time-efficient chart analysis:

Red: Monthly Highs & Lows

Orange: Weekly

Yellow: Daily

Green: 4-Hourly

Blue: Hourly

Indigo: 30-Minute

Violet: 15-Minute

The Monthly and Weekly levels are drawn on all chart timeframes, then the rest are drawn with various granularity settings used to draw levels from one or two timeframes above – to give you either more, finer levels or fewer, stronger levels to suit your trading timeframe and targets.

When a level has a bar breakout we label that bar 0, and subsequent tests of the last level breached are labeled 1, 2, 3 and so on. The principle we work on is that the first touch or re-test of a significant level from either side can have the biggest reaction, with each subsequent test increasing the possibility for the level to be broken.

What is it for?

The Support & Resistance indicator is designed to help traders accurately identify higher-timeframe levels when looking for entry and exit levels on the lower timeframes. These levels are the historical extremes of price movement showing the previous limits of the markets, where the largest profits and losses were made by traders, and are therefore they become significantly memorable levels, and areas of attraction when price subsequently re-approaches to re-tests them.

We use these levels as higher value areas to enter and exit trades – to minimise risk and maximise the reward ratio of each trade. These levels occur on all price charts and are a non-calculated indicator – they show actually historical reversal points in any market at those prices (as opposed to averaging indicators like Moving Averages, Stochastics, RSI etc).

The expectation is that on subsequent retests of these levels price will have the greatest reaction, either when rejected or broken, and therefore can offer the best risk to reward trading opportunities to trade with.

How do we use it?

These areas of value help us to place our stop losses and profit targets at logically significant levels, and form an opinion of future direction – following tests and closes of bars/candles across these levels and expectations to test further levels on either side.

We look for first and second touches of these levels from the same or opposite side of their formation as entry and exit points, and we look for how bars/candles close when they do interact with these levels to manage our trades and decide whether to let them continue to run, adjust them, or close them.

We also look at the speed at which price approaches these levels using our ATR indicator values to try to find exhaustion points in rapid price movements where it could then retrace from a first or second touch.

The best way to understand how they work is to give yourself some chart-watching time, and build experience of using them as part of your trading strategy.

The automation of this will save you a lot of time on technical-trading chart management, and evaluating different instruments to trade – freeing your time for greater discretion and analysis when looking for the best trades and investments for your goals.

Support & Resistance specific settings

In most cases these settings can be left on the default values, although users with different strategies or preferences to our own may want to be able to adjust them.

| Variable | Default Value | Possible Values | Description |

| Detail | medium | fine/medium/wide | “medium” will work well for most instruments and trading strategies but if there are too many lines on a particular instrument then try “wide”. |

| ChartTFPoints | 10 | whole numbers | This is how many highs/lows back to draw the levels from on each timeframe, values between 2 and 20 will tend work best, generally 7 to 12 work well for us but 10 is usually about right. |

| extDepth | 8 | whole numbers | This is the minimum number of bars between highs and lows for them to qualify as a swing point. We have found 8 to give us good strong levels, 3 would be a minimum and show more levels but from lesser swings, and 20 as a maximum would give stronger but fewer swing levels. |

| extDeviation | 1 | whole numbers | This is how many bars after a high must be lower, or after a low must be higher to qualify as a high or low. We use 1 because that gives us all the highs and lows we need but you could try values of 1-20 for more significant but less frequent lines. |

| extBackstep | 2 | whole numbers | This is how many bars before a high must be lower or before a low must be higher to qualify as a high or low. We use 1 because that gives us all the highs and lows we need but you could try values of 1-20 for more significant be less frequent lines. |

Includes all Profiles, Templates and Indicators, with statistics, screen, email and smartphone alerts.

Includes all Profiles, Templates and Indicators, with statistics, screen, email and smartphone alerts.